staples tax exempt certificate

Are exempt from sales tax. Furthermore all services related to the planting or caring of the trees planted on.

Certificate Of Ownership Template Awesome Free Download Illinois Tax Exempt Certificate Luxu Invoice Template Business Plan Template Birth Certificate Template

Corporations filing Form 100X Amended Corporation Franchise or Income Tax Return.

. See Publication KS-1550 Kansas Sales Use Tax for the Agricultural Industry at. Barbed wire T-posts concrete mix post caps T-post clips screw hooks nails staples gates electric fence posts electric insulators and electric fence chargers. Exempt homeowners associations and exempt political organizations filing Form 100.

An exempt organization at any time during regular business hours to verify the validity of the organizations exempt status. The Department of Revenue engaged in the process of drafting administrative rules to provide binding guidance for taxpayers. Napkins straws stirrers plastic knives forks spoons and.

At its core is the notion that the path to success and fulfillment may look entirely different from one student to another. Welcome to Staples High School Staples High School offers a broad and deep curriculum designed to support each student through his or her high school experience and in preparation for the future. Pacific Time on the delinquency date.

Follow the instructions provided to fax or email your certificate. However the following items may not be purchased for resale and do not qualify as exempt packaging materials or supplies. The retail sale of a work-site utility vehicle may be exempt from Kansas sales tax if it meets all statutory requirements.

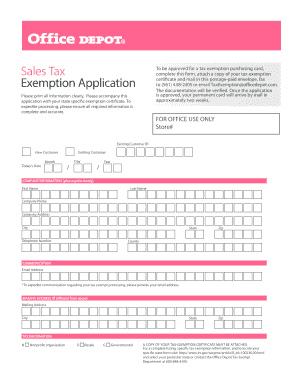

However exempt organizations are required to collect tax on most of their sales of taxable items. Sales tax on goods and services purchased for use by organizations exempt under IRC Section 501c3 4 8 10 or 19. We will keep your tax-exempt information on file until it expires at which time a new copy of your tax ID certificate will be.

Pursuant to California Revenue and Taxation Code Section 2922 Annual Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm. You have certain rights under Chapters 552 and 559 Government Code to review request and correct information we have on file about you.

If you have questions or need more information contact us at 800-252-5555. Includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. If the delinquency date falls on a.

Iowa Code section 4233 subsection 16A to exempt the sale of a grain bin from sales and use tax. The exemption went into effect July 1 2019. Exempt organizations filing Form 199 California Exempt Organization Annual Information Return.

See Exempt OrganizationsSales and Purchases Publication 96-122. To claim the exemption the restaurant or other eating establishment should give its supplier a completed Form ST-120 Resale Certificate. Check with the software providers to see if they support business e-filing.

Texas tax law provides an exemption from.

Office Depot Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Staples Com Customer Service Order Support

Sales Tax On Grocery Items Taxjar

Staples Com Customer Service Order Support

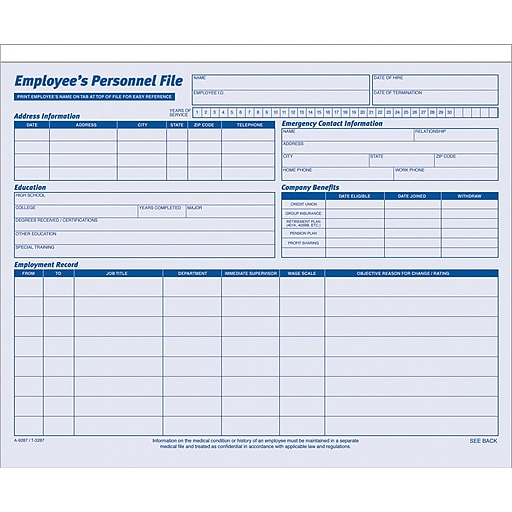

Make Life Easy With Preprinted Forms Staples

Pta Job Descriptions Staples High School

Lunch Rotation Staples High School

Make Life Easy With Preprinted Forms Staples

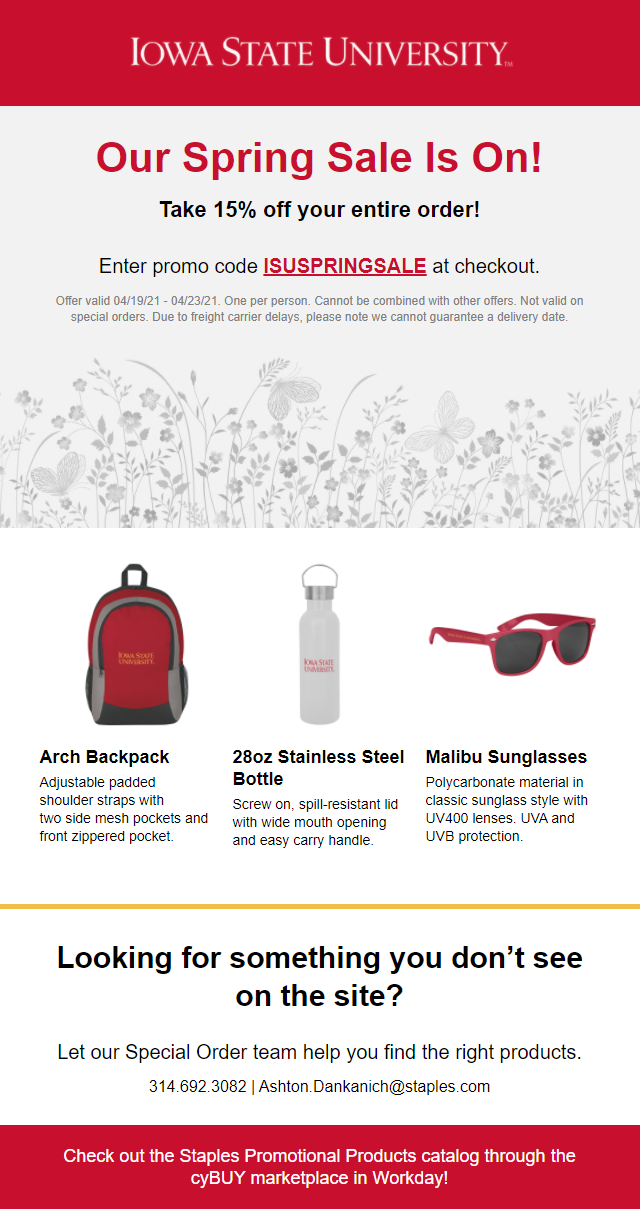

Staples Promotional Product Catalog Offer Procurement Services Iowa State University

Staples All Purpose Frame 8 1 2 X 11 507954 Walmart Com

Skilcraft Staples By Abilityone Nsn2729662 Ontimesupplies Com

Staples Diamond Clear Wall Mountable Display Protectors Clear Letter 10 Pk 15945 Walmart Com